mississippi auto sales tax calculator

Mississippi Sales and Use Taxes Sales Tax All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the. The calculator will show you the total sales tax amount as well as the.

How To Register A Car In Mississippi Yourmechanic Advice

For example lets say that you want to purchase a new car for 30000 you.

. For vehicles that are being rented or leased see see taxation of leases and rentals. 56 county city. Please call the office if help is needed.

Car tax rates listed by state with county and local vehicle tax lookup tools. Assessed value has been established as 30 of the Manufacturers Suggested Retail Price plus a reduction of a certain percentage for depreciation over 10 years. You can calculate the sales tax in Mississippi by multiplying the final purchase price by 05.

The Vehicle License Fee is the portion that may be an. 635 for vehicle 50k or less. Before-tax price sale tax rate and final or after-tax price.

You can use our Mississippi Sales Tax Calculator to look up sales tax rates in Mississippi by address zip code. New car sales tax or used car sales tax. Mississippi car payment calculator with amortization to give a monthly breakdown of the.

You can use our mississippi sales tax calculator to look up sales tax rates in mississippi by address zip code. In addition to taxes car. Sales of automobiles and trucks over 10000 pounds gross weight to electric power associations 1 Trucks greater than 1000000 lbs aircraft semitrailers mobile homes and modular.

Sales Tax Laws Title 27 Chapter 65 Mississippi Code Annotated 27-65-1 Use Tax Laws. Mississippi Tax Calculator Car. Registration fees are 1275 for renewals and 1400 for first time.

700 Mississippi State Sales Tax -675 Maximum Local Sales Tax. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Sales and Gross Receipts Taxes in Mississippi amounts to 53.

With local taxes the total sales tax rate is between 7000 and 8000. How to calculate mississippi sales tax on a car. A minimum assessed value is.

00 for first time registrations Loans Credit Repair Small Business Bookkeeping Tax School DeepBlue 5 tax rate then all shipments within that state. Select Community Details then click Economy to view sales tax rates. You can use our.

This calculator can help you estimate the taxes required when purchasing a new or used vehicle. You pay tax on the sale price of the unit less any trade-in or rebate. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Mississippi local counties cities and special taxation.

Before Tax Price Sales Tax Rate. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. Vehicle sales tax MISSISSIPPI Tax and Tag Calculator Use the tax and tag calculator offered for MS residents so you can see the actual costs you will pay for tax and tags on the vehicle during.

Mississippi vehicle sales tax calculator. Average Local State Sales Tax. Anytime you are shopping around for a new vehicle and are beginning to make a budget its.

View pg 1 of chart find total for location. 4 Ways to Calculate Sales. Mississippi Car Tax Calculator.

Our sales tax calculator will calculate the amount of tax due on a transaction. Mississippi Car Sales Tax Calculator. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Mississippi State Sales Tax. Maximum Possible Sales Tax. Mississippi Vehicle Tax Calculator.

26 rows Select location. Maximum Local Sales Tax.

8 375 Sales Tax Calculator Template

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Missouri Sales Tax Rate Rates Calculator Avalara

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Tax On Cars And Vehicles In Kansas

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax Laws By State Ultimate Guide For Business Owners

Ohio Sales Tax Guide For Businesses

2022 Capital Gains Tax Rates By State Smartasset

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

The Most And Least Tax Friendly Us States

What Small Business Owners Need To Know About Sales Tax

Sales Tax Definition How It Works How To Calculate It Bankrate

Tax Free Weekend Mississippi 2022 What You Need To Know

Ford Dealership Southaven Tn Ford Sales Specials Service Autonation Ford Memphis

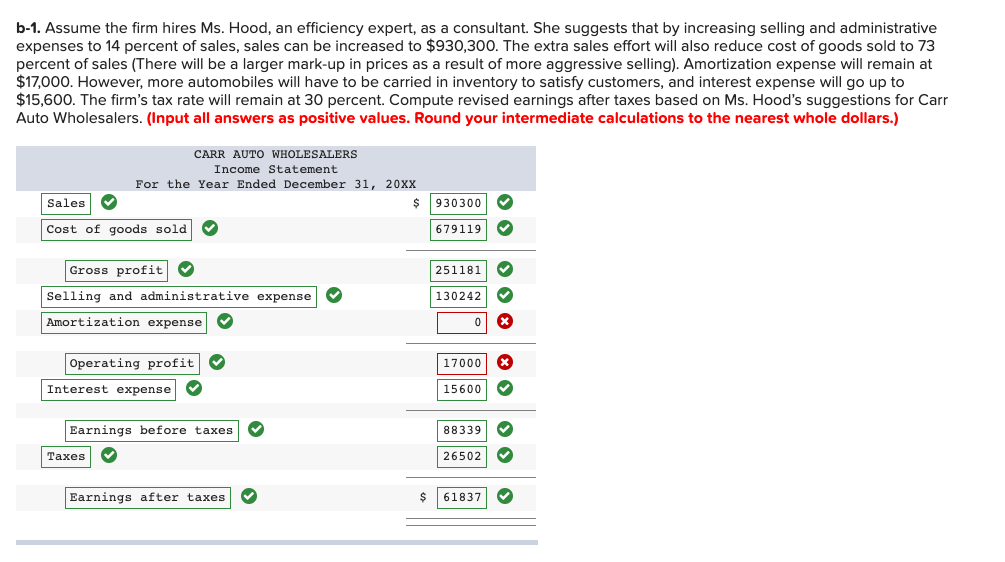

Solved Carr Auto Wholesalers Had Sales Of 880 000 In 20xx Chegg Com